Why The Crypto Correction of August 2024 Was Not The Worst By Far...

Why The Crypto Correction of August 2024 Was Not The Worst By Far...

Let's scratch 'The Last Fortnight In Crypto' and run headlong into what just transpired over the last few days shall we?

Unless you've been living under a rock, you'll know the crypto market made it's 'healthiest correction' yet adjusting down by a near jaw-dropping $300 billion in a single day! Bitcoin plummeted by 12%, while Ethereum tumbled a staggering 21%. Understandably, 'some' are hitting the panic button, but many of the big investors are looking at it quite differently (do you remember our blog on how to use the Fear & Greed Index to your advantage)? The massive drawdown - as was experienced at the beginning of the week - is seen as a prize opportunity by those who understand that historically, this wasn't even the biggest drop experienced; and that 'buying the dip' will no doubt reap the bigger rewards in the longer term. Corrections are part of the cycle.

If we look backwards to move forwards - Bitcoin's journey really has been nothing short of historic, and we are not just saying that because we are a #cryptosavings app. It's been marked by significant milestones (both up and down) but mostly by steady growth. As the 'pioneering' cryptocurrency, Bitcoin has shown its potential for impressive returns while cementing its place as a reliable digital asset. From its early days of groundbreaking advancements to recent US Presidential Election developments, Bitcoin continues to be influenced by global trends and key figures - so while it can experience its fair share of volatility, historically Bitcoin has consistently represented the far more robust and evolving market in the Crypto sphere.

In this blog, we explore the seven most significant moments in Bitcoin's history, examining the factors that shaped these pivotal events and the valuable lessons they offer to investors. By understanding these key moments, we provide a comprehensive overview of Bitcoin's resilient past, offering insights into how the market adapts to various influences and how informed investors can navigate this promising space. Even if you have just started out in the #cryptocurrency space, it's worth noting these milestones and what they might signify for the future of your cryptocurrency investment.

1. June 2011: The First Major Crash (-99%)

In June 2011, Bitcoin faced its first major crash, plummeting from $32 to $0.01 on the Mt. Gox exchange. This 99% drop was triggered by a massive security breach, highlighting the risks associated with nascent technology and unregulated markets.

2. April 2013: The Cypriot Financial Crisis Impact (-83%)

Bitcoin surged to $266 in April 2013, largely driven by the Cypriot financial crisis. However, the bubble burst quickly, and prices fell by over 50% within hours. This crash underscored Bitcoin’s sensitivity to macroeconomic events and investor sentiment.

3. December 2013: The China Ban (-50%)

In late 2013, Bitcoin reached $1,000 for the first time, driven by increased interest from China. When the Chinese government banned financial institutions from using Bitcoin, the price dropped by 50% almost overnight, demonstrating the influence of regulatory actions on crypto markets.

4. December 2017: The ICO Frenzy Burst (-84%)

Bitcoin's meteoric rise to nearly $20,000 in December 2017 was fueled by the ICO craze. As the bubble burst, Bitcoin's value plummeted to $6,000 by February 2018. This crash highlighted the speculative nature of the crypto market and the potential for rapid corrections.

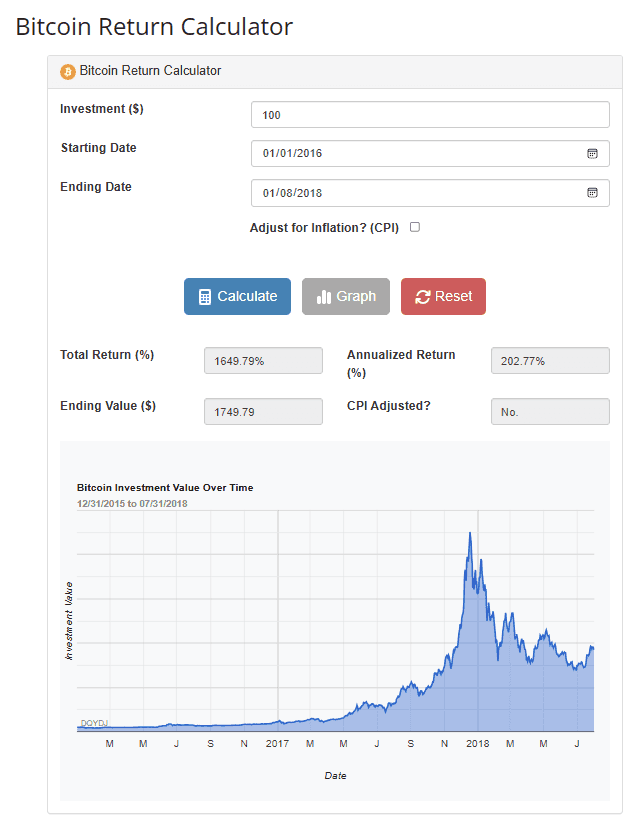

At this point, we thought we'd show you that not only are corrections are cyclical but that investing also requires a little patience. If you invested $100 in January of 2016 and only ceased that investment in August of 2018 you have not only made a total return of 1649.79% (Ending value of $1749.79) but you also rode the ICO Frenzy Burst to get there. You can use this calculator at any time to play around.

5. March 2020: The COVID-19 Pandemic (-50%)

The global COVID-19 pandemic triggered a massive sell-off across financial markets, including Bitcoin. In March 2020, Bitcoin’s price fell from $9,100 to $4,100 in a single week, showing its vulnerability to global economic shocks.

6. May 2021: The Elon Musk and China Effect (-53%)

Bitcoin saw a significant crash in May 2021, dropping from $58,000 to $30,000. This crash was influenced by Elon Musk’s comments on Bitcoin’s environmental impact and China’s renewed crackdown on cryptocurrency mining and trading. The event highlighted how influential figures and countries can sway the market.

7. June 2021: The Death Cross (-28%)

In June 2021, Bitcoin experienced another sharp decline, driven by the "Death Cross" — a technical indicator where the 50-day moving average crosses below the 200-day moving average. Bitcoin's price fell from $40,000 to $29,000, reminding investors of the importance of technical analysis in crypto trading.

Conclusion

Bitcoin's history is marked by significant crashes, much like the one we recently experienced on August 5, 2024, that have tested the resolve of its investors. While these events can be daunting, they also present opportunities for those who understand the market's cyclical nature. As always, staying informed and cautious is key when navigating the world of cryptocurrency.

Crypto Jargon – The Phrases You Hear but Don’t Understand Explained!

How to Find Reliable Crypto Information

5 companies that changed their mind about Bitcoin.

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter