Does Zippay, Humm or Afterpay affect Credit Score?

Does Zippay, Humm or Afterpay affect Credit Score?

If you're looking for a way to spread the cost of your purchase over time, then you've probably heard of buy now pay later platforms like Afterpay, Zip and Humm. These platforms allow you to make purchases now and pay for them over time, without having to worry about interest rates or late payment fees. But does using these platforms affect your credit score? In this blog post, we'll take a look at how these platforms work and what effect they have on your credit score.

What is Buy Now Pay Later?

Buy Now Pay Later is a type of financing that allows consumers to purchase items and pay for them over time. This type of financing can be beneficial for both buyers and sellers. For buyers, it can help them afford items that they may not have the cashflow for currently. And for sellers, it can help them sell more expensive items.

There are a few things to keep in mind if you're considering using Buy Now Pay Later financing. First, make sure you understand the terms and conditions of the agreement. Second, be aware of any fees or interest rates that may apply to missed payments. Lastly, remember that you will need to make payments on time in order to avoid late fees or potential damage to your credit score.

What is Zip Pay?

Zip Pay is a new payment method that allows customers to shop now and pay later. There are no interest or fees associated with using Zip Pay, making it a great option for those who want to budget their spending. Simply create an account and add your credit or debit card details. Once you're approved, you can start shopping at any of the thousands of stores that accept Zip Pay.

To use Zip Pay, simply select it as your payment method at checkout. You'll be asked to enter your Zip code and agree to the terms and conditions. Once you've been approved, you can start shopping! Just remember to make your payments on time to avoid any late fees.

How does it work?

It's easy! Just create an account and add your credit or debit card details. Once you're approved, you can start shopping at any of the thousands of stores that accept Zip Pay.

To use Zip Pay, simply select it as your payment method at checkout. You'll be asked to enter your Zip code and agree to the terms and conditions. Once you've been approved, you can start shopping! Just remember to make your payments on time to avoid any late fees, and also ensure you read the relevant product disclosure statement.

What are the benefits?

There are many benefits to using Zip Pay, including:

-No interest or fees associated with using Zip Pay

-Allows you to budget your spending by breaking up payments into instalments

-Thousands of stores accept Zip Pay

Remember, just make sure to keep up with your payments to avoid any late fees. Additionally, try to avoid any serious credit infringement, as it can impact your credit score. If you don’t know what yours is, then get a credit check.

Does ZipPay affect your credit score?

Yes, ZipPay can affect your credit score. You can use ZipPay without impacting your credit report or credit history, provided you make all payments on time. This means that you can shop now and pay later without affecting your ability to get loans in the future. However, if you make any late payments using ZipPay, it will impact your credit score and credit history. So make sure you take this into consideration before using the platform, as this may impact your outcome with future credit providers.

What is Humm Pay?

Humm Pay is a new way to pay for your online purchases. It's an easy and convenient way to shop, and you can use it anywhere that accepts a Visa card. Humm Pay is a safe and secure way to pay for your online shopping. You can use your credit or debit card to make payments, and your personal information is never shared with the merchant. You aren’t required to complete any credit checks to sign up with Humm Pay.

What are the benefits of using Humm Pay?

There are a couple of benefits of using Humm Pay.

First, it's an easy and convenient way to shop. You can use it anywhere that accepts Visa, so you're never far from being able to make a purchase.

Second, Humm Pay is a safe and secure way to pay for your online shopping. Your personal information is never shared with the merchant, so you can shop with confidence.

Third, it can help you better manage cash flow for larger item purchases.

Fourth, there is no credit check required to sign up to the service.

Does Humm Pay affect your credit score?

Humm Pay can affect your credit score or credit rating. This will depend on how you use the platform. If you make all your payments on time, then your credit score or credit rating won't be impacted at all.

However, if you miss a payment or default on your payments, this may affect your credit score or credit rating negatively. As with other Buy Now Pay Later services you should definitely take this into consideration before using a BNPL service.

Having a mark against your credit report will make it a lot harder in the future if you wish to make credit or loan applications. For example looking to get a mortgage for a house.

What is Afterpay?

Afterpay is a service that allows you to pay for your purchase over four equal installments, due every two weeks. There's no interest or added fees*, so long as you pay on time. It's the perfect way to manage your finances and enjoy your purchase now.

How does it work?

If you're shopping online, select Afterpay at checkout. You'll be redirected to Afterpay's website to register and provide your payment details (Visa or Mastercard). Importantly, you aren;t required to complete a credit check to sign up to Afterpay.

Once you've been approved, you'll be returned to the merchant site to complete your purchase. In-store, inform the cashier that you'd like to use Afterpay and provide them with your mobile number. The cashier will then process your payment via Afterpay's point-of-sale device.

*Late fees may apply if you fail to make a payment on time. Make sure you check out Afterpay's terms and conditions for more information.

What are the benefits of using Afterpay?

There are plenty of benefits for using Afterpay! Here are just a few:

• You can enjoy your purchase now and pay it off over four equal instalments, due every two weeks.

• There's no interest or added fees (as long as you pay on time). So, using Afterpay won't affect your credit score.

• It's easy to use! If you're shopping online, simply select Afterpay at checkout. In-store, just inform the cashier that you'd like to use Afterpay and provide them with your mobile number.

• You can use Afterpay at thousands of popular retailers.

• You don’t require a credit check to sign up.

Does Afterpay affect credit score?

So, does using Afterpay hurt your credit score or credit rating? The short answer is no, using Afterpay doesn’t hurt your credit score. Afterpay states they will never do credit checks or report late payments to credit reporting agencies. So this is a differentiating factor of Afterpay from other BNPL later platforms.

While Afterpay doesn't report late payments to any credit reporting bureaus or a relevant credit reporting body, it doesn’t give users free reign to abuse this freedom. They have built in mechanisms to prevent users from over extending their “credit limit”. Make sure you manage your cash flow appropriately if you opt to use a Buy Now Pay Later service.

Pros and cons of using But Now Pay Later Platforms

Pros of Buy Now Pay Later Platforms

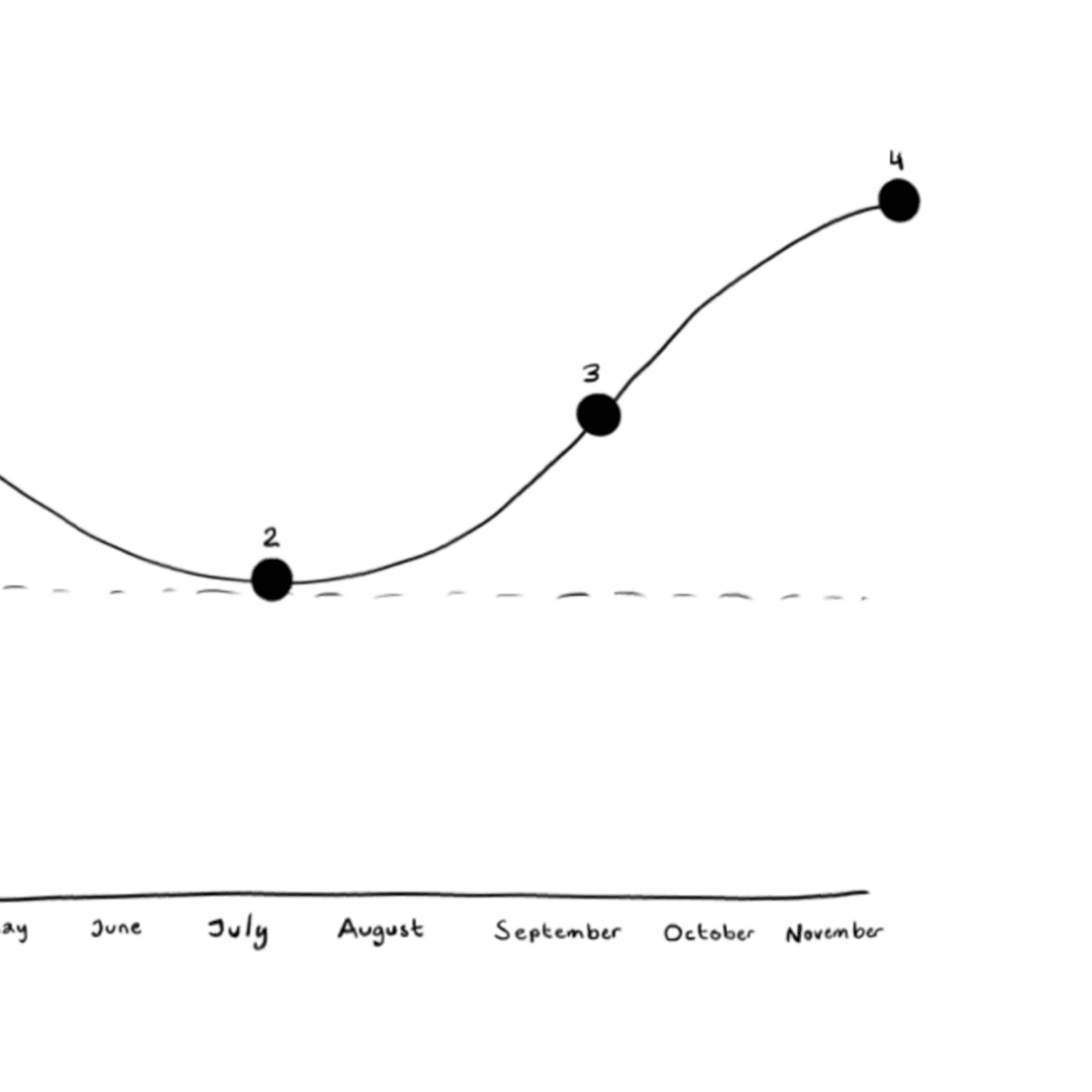

There are a few key reasons why these platforms can be advantageous for shoppers and have grown in popularity.

First, they provide an alternative to traditional forms of credit, like credit cards or personal loans.

Second, they can help people manage their finances by allowing them to spread the cost of a purchase over time.

Third, they can be a useful tool for budgeting and cash flow management.

Fourth, a credit check from a credit provider is often not required to gain access to these BNPL platforms.

Cons of Buy Now Pay Later Platforms

There are a few potential drawbacks to using buy now pay later platforms that consumers should be aware of before signing up for one.

First, if you're not careful, it's easy to get caught in a cycle of debt with these types of platforms. Since you're essentially borrowing money from the platform every time you make a purchase, it can be easy to keep spending without ever really paying off what you owe.

Second, many buy now pay later platforms have high interest rates or penalty fees if repayments aren’t made on time.

Finally, some buy now pay later platforms can impact your credit report or credit score if you make late payments. While most BNPL platforms don’t run credit checks to start, some do impact your credit score, so be aware of this.

Who should use Buy Now Pay Later platforms?

There is no one-size-fits-all answer to this question. Ultimately, it depends on your individual financial situation and needs. However, Buy Now Pay Later platforms could be an option for people who:

-Have good credit and can afford to make payments on time

-Are looking for a way to finance a large purchase or manage cash flow

-Want more flexibility than traditional loans or credit cards offer

If you fit into one or more of these categories, Buy Now Pay Later could be a good option for you. Just make sure to do your research before signing up for any platform, so you can find the one that best meets your needs.

Final thoughts

Overall, buy now pay later platforms can be a great way to make purchases without having to pay for them upfront. However, it's important to be aware of the potential drawbacks before signing up for one of these services.

If you're not careful, you could end up in debt or paying more in interest fees than you would with a traditional credit card, or with a platform that will impact your credit score. So be sure to do your research and only sign up for a buy now pay later platform if you're confident that you can manage your finances responsibly.

Active vs Passive Investing: What's the Difference

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter