What is a Good Credit Score in Australia & How to Check?

What is a Good Credit Score in Australia & How to Check?

What is a good credit score in Australia? This is a question that many people are asking nowadays. With the global financial crisis still fresh in people's minds, more and more Australians are becoming interested in their credit rating and what they mean for their overall financial health. In this blog post, we will discuss what a good credit score is in Australia, as well as how to get a free credit score check yourself. Stay tuned!

What is a credit score?

Your credit score is a number that represents your creditworthiness. It is used by lenders to determine whether you qualify for a personal loan and what interest rate you will be charged. Your credit score is determined by credit reporting bodies like Equifax, Experian and Dun & Bradstreet. A high credit score indicates that you are a low-risk borrower, while a low credit score indicates that you are a high-risk borrower.

There are many factors that go into your credit score, including your payment history, previous credit behaviour, the amount of debt you owe, the length of your credit history, and the types of accounts you have. You can get your free annual credit report from a credit provider in Australia.

Credit Score Ranges

| Credit Score Range* | Equifax | Experian | Illion |

|---|---|---|---|

| Excellent | 833 - 1200 | 800 - 1000 | 800 - 1000 |

| Very Good | 726 - 832 | 700 - 799 | 700 - 799 |

| Average | 622 - 725 | 625 - 699 | 500 - 699 |

| Fair | 510 - 621 | 550 - 624 | 300 - 499 |

| Low | 0 - 509 | 0 - 549 | 0 - 299 |

* Ranges are just a guide

What is a good credit score in Australia?

There's no definitive answer, as creditors will often have different requirements and scoring models. However, a score of 700 or above is generally considered to be very good.

Creditors will also take into account other factors such as your income, employment history, previous loan or credit applications, credit obligations and credit enquiries. So even if your score isn't perfect, you may still be able to get approved for a home loan or credit card.

If you're not sure what your score is, you can check it for free on websites like Credit Simple or Illion Credit Score. Then, if necessary, take steps to improve your credit rating. This could involve ensuring you pay bills, maintaining a good repayment history and using less than 30% of your available credit limit. By doing this, you'll not only improve your chances of being approved by credit providers, but you may also get a better interest rate.

What is a bad credit score?

A bad credit score in Australia would be anything under 500. If you are in this area, you should look into ways to improve your credit score. Otherwise you may face unfavourable outcomes when seeking credit products and services.

How to check your credit score in Australia?

You can check your credit score or credit rating through a number of ways in Australia. The most common way is to request a free credit report from a major credit reporting body, the three major ones are Equifax, Experian or Dun & Bradstreet. You are entitled to request one free copy of your credit report from each body every 12 months.

It's important to check your credit report regularly as it can help you keep track of and build a strong credit history and identify any potential errors or fraudulent activity. If you find any inaccuracies on your credit reports, you can contact the relevant credit bureau to have them corrected.

Other alternatives like Credit Simple exist to allow you to access your credit score for free. However you choose to access your credit score, you will need to provide some personal details to either the credit bureaus or companies so they can build your credit file. It's important to stay on top of your credit health to maintain a good score and access to the best loan and credit products.

Factors that influence your credit score

Your credit score is one of the most important numbers in your financial life. A good credit score can mean the difference between getting a loan and being denied, or getting a lower interest rate and paying more in interest. There are many factors that go into your credit score, and understanding them can help you improve your score.

Some of the biggest factors that influence your credit score are your payment history and how much debt you have. Your payment history includes all of your past payments on loans, credit cards, and other debts. If you have missed payments or made late payments, it will hurt your score. Having a lot of debt also hurts your score, because it shows that you might have trouble making all of your payments.

Other important factors include the length of your credit history and the types of credit you have. If you have a long history of making on-time payments, it will help your score. Having different types of credit, such as both revolving credit (like credit cards) and instalment loans (like car loans), can also help your score.

You can get free copies of your credit report from each of the three major credit reporting agencies once per year. Reviewing your reports regularly can help you catch errors and identify any negative information that might be dragging down your score. If you find anything inaccurate, you can file a dispute with the credit bureau to have it removed from your report.

What happens if you don't have a good credit score?

If you have bad credit, it can feel like you're stuck in a financial rut. But there are steps you can take to improve your credit score and get back on track. A bad credit score can make it difficult for loan applications with financial institutions, rent an apartment, or even get a job.

Landlords and employers often check credit scores as part of their application process. A low score can also mean you'll pay more for car insurance or utility deposits.

There are a few things you can do to improve your credit score, like paying your bills on time and keeping your debt levels low. You can also check your credit report for errors and dispute any inaccuracies. By taking these steps, you can help improve your credit score over time.

If you're struggling with poor credit, it's important to seek out professional advice and personal advice. A financial counsellor or adviser can assist you in creating a budget and developing a plan to improve your credit score. With the right help, you can get your financial situation back on track and improve your credit score over time.

How to improve your credit score?

Your credit score is a three-digit number that represents how likely you are to repay debt. A credit provider uses it to decide the outcome of your credit applications and whether to give you credit or approve a loan. A high credit score means you're a low-risk borrower, which could lead to better loan terms.

There are a few things you can do to improve your credit score:

- Check your credit report for errors and dispute any inaccuracies

- Make all of your payments on time, including utility bills and rent payments (repayment history is crucial)

- Keep your balances low on credit cards and other revolving accounts

- Pay off debt rather than moving it around

By following these simple tips, you can improve your credit score and make yourself a more attractive borrower to potential lenders.

FAQ's

How do I dispute an incorrect Australian credit score report?

If you find an error on your credit report, you can dispute it with the credit reporting agency. You will need to provide supporting documentation to prove that the information is incorrect.

The credit reporting agency will then investigate and make a determination. If they find that the information is inaccurate, they will remove it from your credit report. If you are still not satisfied, you can file a complaint with the Australian Financial Complaints Authority. It's important to keep an eye on your credit scores because it can impact your ability to get loans and lines of credit.

What are the consequences of having a bad credit score?

A bad credit score can have a number of consequences. More often than not it makes it harder to access a credit product, like a home loan or credit card. But in some cases you will be subject to less favourable interest rates as you are deemed a riskier borrower.

Is 700 a good credit Score?

The Australian credit average score is between 500 - 650. So yes, if you have a credit score of 700 or above that is a very good score to have.

Buying a house with bad credit?

Having a bad credit score while buying a house can impact you in many ways. The first way is you may not be given a loan. One of the other ways is you may end up with a higher interest rate. This is because in the eye of the creditor you are a higher risk borrower. That is why it is important to have a good credit score to buy a house.

Conclusion

Your credit score is important because it can affect your ability to borrow money, get a job, rent an apartment and even buy insurance. By understanding what makes up your credit score and how you can maintain a good credit score, you can ensure that this important number stays in good shape. You can check your credit score for free at any time on the Credit Reporting Agency websites we listed earlier.

Active vs Passive Investing: What's the Difference

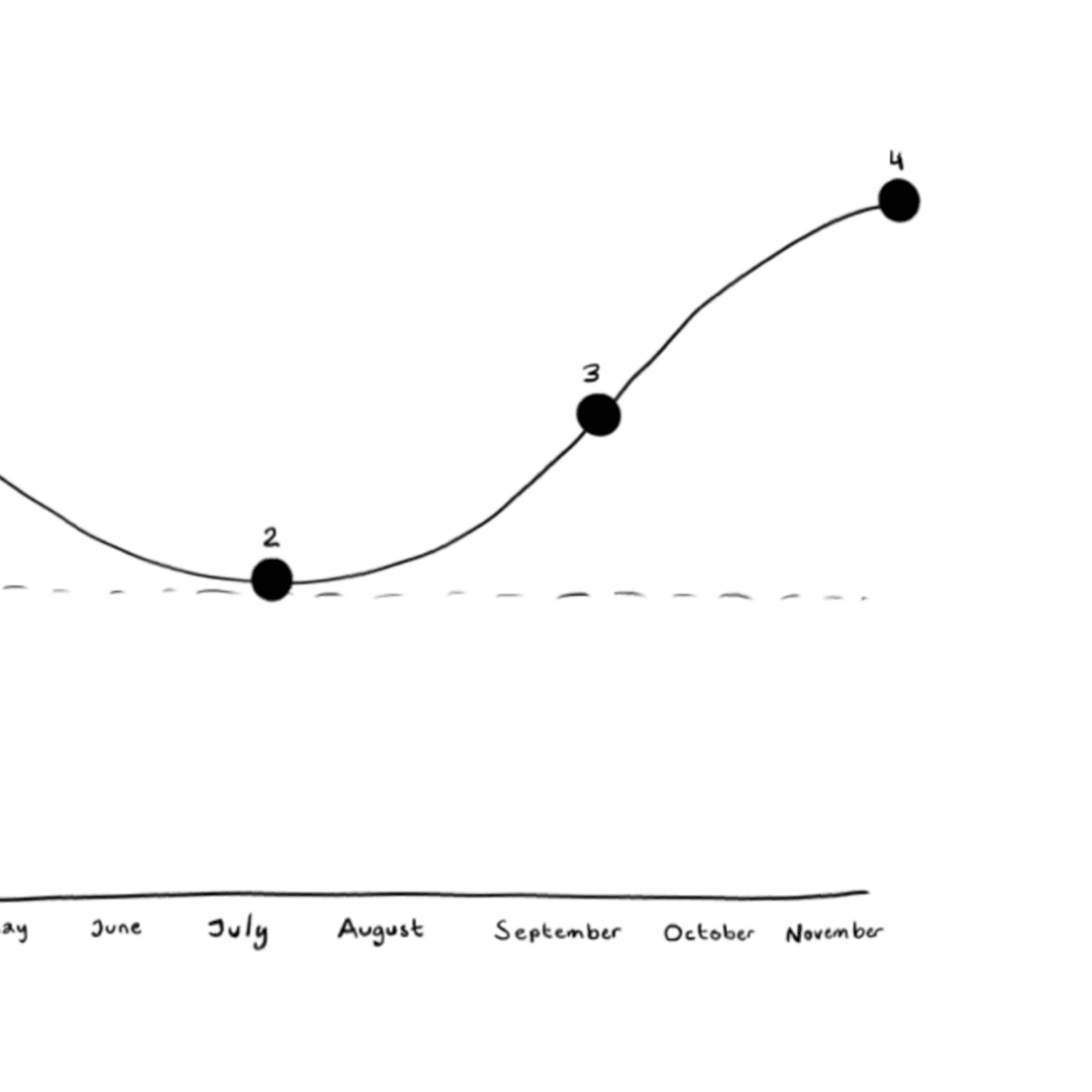

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter