The Next Bitcoin Halving Event: What to Expect (Historically)

The Next Bitcoin Halving Event: What to Expect (Historically)

Bitcoin is a digital asset and a payment system, invented by Satoshi Nakamoto. Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. Bitcoin was first released as open-source software in 2009.

Since its inception, Bitcoin has gone through several cycles of price appreciation and depreciation. These cycles have typically lasted for about 4 years, with each cycle culminating in a halving event.

The halving event is a process in which the reward for mining a block of Bitcoin is cut in half. This occurs every 210,000 blocks, or roughly every 4 years. The halving event has historically been followed by a bull market, as the reduced supply of Bitcoin drives up demand.

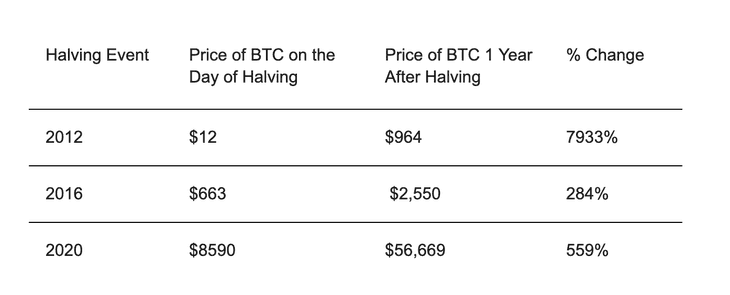

The first halving event occurred in 2012, and was followed by a bull market that saw the price of Bitcoin rise from $12 on the day of the halving, to $964 a year later. The second halving event occurred in 2016, and was followed by a bull market that saw the price of Bitcoin rise from $663 to $2,550.

The third halving event occurred in 2020, and was followed by a bull market that saw the price of Bitcoin rise from $8,740 on the day of halving, to around $56,669 a year later.

The next halving event is scheduled to occur in 2024. While it is impossible to say for certain what will happen to the price of Bitcoin after the next halving event, historical data would suggest that a bull market could ensue, as seen in the diagram below.

The following table shows the price of Bitcoin before and after each halving event:

While it would have been close to impossible to time an investment, looking at the price history of Bitcoin - one way to have made the most of the upside would have been to dollar-cost average (DCA) into Bitcoin. The DCA is a strategy where you invest a fixed amount of money into Bitcoin on a regular basis, regardless of the price. This helps to average out the cost of the investment and reduces your risk.

For example, if you invested $50 per week into Bitcoin between the last three halving events, you would have invested a total of $1,040. Your investment would have grown to $12,763 by the end of the third halving event, a return of 1,227%.

In closing, Bitcoin has historically run in 4-year cycles, with each cycle culminating in a halving event. Every halving event since the creation of Bitcoin has been followed by a bull market, as the reduced supply of Bitcoin drives up demand. While it is impossible to say for certain what will happen to the price of Bitcoin after the next halving event, historical data would suggest that a bull market could ensue.

Disclaimer:

The information provided in this article is for informational purposes only and should not be construed as financial advice. The information provided should not be relied upon for financial decisions. The author is not a financial advisor and is not qualified to provide financial advice.

The author does not endorse any of the products or services mentioned in this article and is not responsible for any losses or damages that may occur as a result of using the information provided in this article.

It is important to do your own research (DYOR) and understand the risks involved before investing in any cryptocurrency or other financial product. You should also consult with a financial advisor before making any investment decisions. Investing in cryptocurrencies is a high-risk investment. You should only invest money that you can afford to lose.

Crypto Jargon – The Phrases You Hear but Don’t Understand Explained!

How to Find Reliable Crypto Information

5 companies that changed their mind about Bitcoin.

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter