What history tells us about War and the Market…

What history tells us about War and the Market…

On February 24, 2022, stock markets around the world were hit by heavy losses after Russia invaded the neighbouring European nation of Ukraine. The leading tech-stock index, the NASDAQ, fell by 3% and the benchmark S&P 500 index wasn't far behind. Both the New York Stock Exchange (NYSE) and the NASDAQ have now halted trading of Russian stocks in wake of sanctions imposed by the U.S.

Despite the dips, Haris Anwar, U.S. markets analyst at Investing.com, sees long-term potential in tech stocks:

"If you are a buy-and-hold investor, it makes sense to keep some solid, large-cap technology stocks in your portfolio. These companies can withstand wars, recessions, or pandemics better than their smaller-cap counterparts, thus providing safety during times of distress."

Companies that rely heavily on the Russian market are also badly affected, with stocks of vehicle manufacturer Renault bleeding by 13%. Naturally, the Moscow MOEX, Russia's leading stock exchange, was hit the hardest, falling by 45% as sanctions on the country were announced. The Russian ruble continues to fall rapidly against the dollar, with the cost of one dollar up from 80 RUR to 113 RUR in the past week.

Economic Outlook

With most of the world still reeling from the economic damage caused by the COVID-19 pandemic, the timing of this new crisis is less than ideal. Rising inflation and slow economic growth mean the global economy risks slipping back into a situation similar to that of the 1973 oil crisis.

Russia currently supplies roughly a third of the EU's natural gas, so any disruption to delivery could have severe knock-on effects, driving up the cost of utilities, shipping costs, and, subsequently, basic goods. Without immediate action to mitigate further disruption, short-term increases in the cost of living are inevitable. Investors should consider the implications of these increases and plan accordingly by redirecting funds to stocks that historically benefit during times of crisis.

Cryptocurrency as a Safe Haven?

In an unexpected turn of events, the cryptocurrency market has suffered some collateral damage, with Bitcoin crashing from $39,000 to $34,500. The falling prices have resulted in a flood of criticism from traditional investors, quick to point out that Bitcoin might not be the safe-haven people often promote it as during times of crisis.

"The crisis has exacerbated market jitters and investors are fleeing risk-related assets, such as high-growth tech stocks, and cryptocurrencies, and instead are heading towards the relative safety of the U.S. dollar and Treasurys," said Jesse Cohen, senior analyst at Investing.com.

Recovery was swift, though, and Bitcoin was back above $40,000 within a week, quelling any skepticism from critics. Now at $2 trillion, the overall crypto market is up 15% in the past week but still has some way to go to regain last November's all-time high of $3 trillion.

Gold and Energy

In contrast, traditional safe-haven assets like gold enjoyed a boost on news of the Russian invasion. Gold rose by 3% to hit a 13-month high of $1,950, while silver enjoyed similar price action, closing near $25.50, the highest since November last year.

"Gold surged by more than 3%, breaking the $1,950 level for the first time in 13 months," notes Pinchas Cohen, global markets analyst at Investing.com. "The yellow metal's rise at the same time as a rally in the dollar demonstrates investors' eagerness for safe havens as risk appetite evaporated. During normal times, the two assets tend to have a negative correlation.

Energy stocks also spiked on the news, with natural gas futures contracts gaining nearly 20% and Brent crude jumping to $103 a barrel. The invasion has resulted in Germany halting development of the Nord Stream 2 gas pipeline which was intended to import gas from Russia to Europe. Now, the country is considering stopping all energy imports from Russia and extending the life of local coal power plants.

Time to Buy?

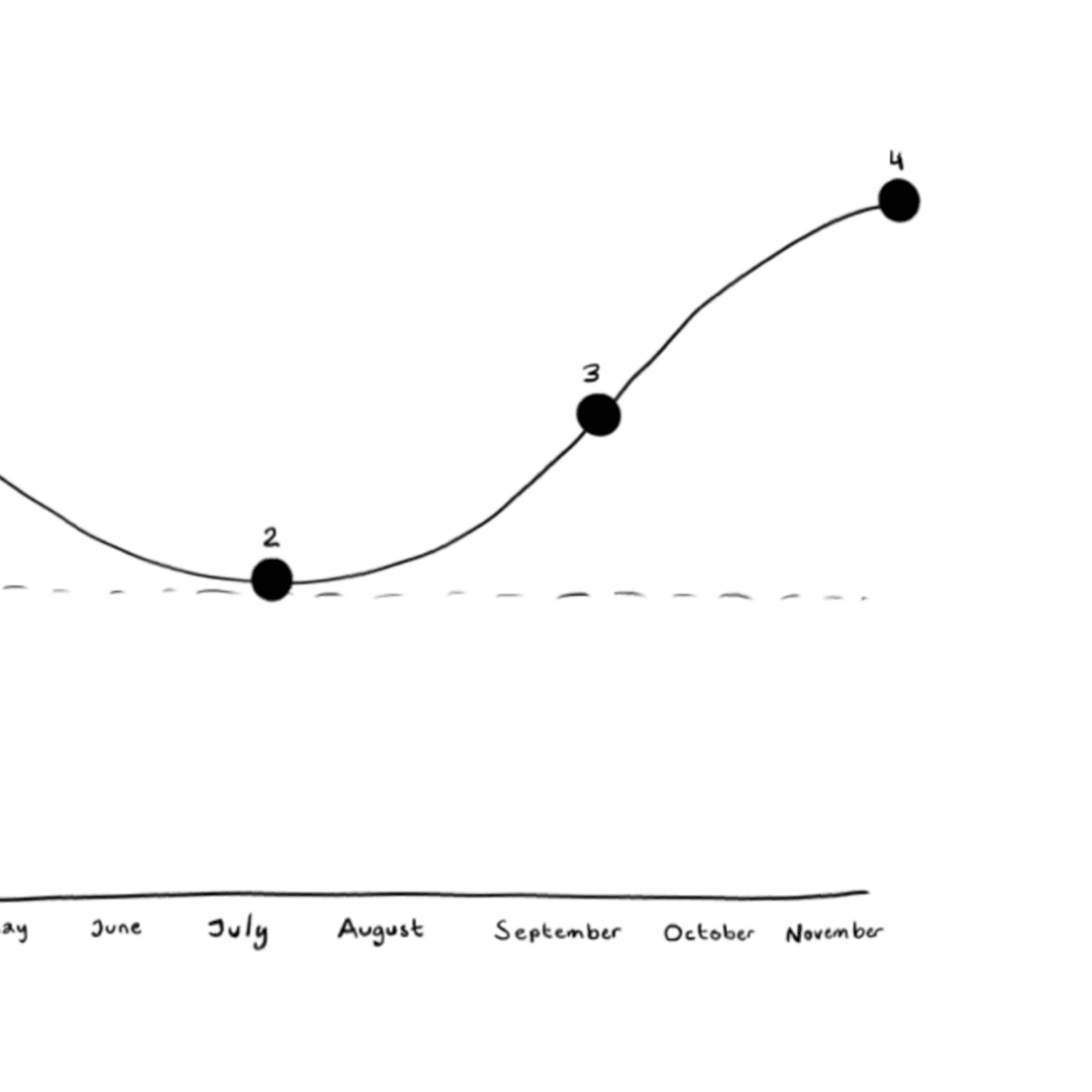

A study conducted by CFRA Research found that stock markets fully recover all losses within an average of 47 days following major geopolitical events. The study included 20 major events that have occurred since World War II, with markets dropping by an average of 5% before recovery.

Rather than fear further losses, savvy investors should take advantage of these market dips and secure some low-priced entry points in assets like gold and cryptocurrencies. Beyond just personal benefit, this type of capital inflow is often critical to maintaining economic stability and shoring up markets in times of crisis.

“As serious as this escalation is, previous experiences have indicated it may be unlikely to have a material impact on U.S. economic fundamentals or corporate profits,” said LPL Financial Chief Investment Strategist John Lynch. Defence stocks have also been cited as a good option for investors looking to expand their portfolios.

"Further escalation in the ongoing geopolitical conflict would likely have a positive impact on the prices of defense sector stocks, such as Lockheed Martin and Raytheon, which supply the U.S. military and its NATO allies with fighter jets and advanced missile systems," says Cohen

Despite ongoing ceasefire talks held in Belarus, there is no clear sign that Russian President Vladimir Putin plans to end the invasion anytime soon. While markets are likely to recover, economic instability is a certainty that demands careful planning for investors that hope to come out on top.

Disclaimer:

Past performance may not be indicative of future results. Therefore, you should not assume that the future performance of any specific cryptocurrency will be profitable or equal to corresponding past performance levels. Each investing decision you make should be determined with reference to the specific information available and not based on past performance.The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Active vs Passive Investing: What's the Difference

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter