What is a Crypto ETF & How to Invest?

What is a Crypto ETF & How to Invest?

If you're looking for a way to invest in the cryptocurrency market, you may be wondering about crypto ETFs. An ETF, or exchange traded fund, is a type of security that allows investors to pool their money together and invest in a basket of underlying assets. In this blog post, we'll discuss what crypto ETFs are and how you can invest in them.

What is a Cryptocurrency ETF?

An ETF is a type of investment fund that holds a basket of underlying securities or assets, such as stocks, bonds, or commodities. Cryptocurrency ETFs would hold a basket of digital assets, such as Bitcoin, Ethereum, Litecoin, etc. Therefore crypto ETFs provide investors exposure to crypto assets without having to physically hold any crypto assets themselves.

A crypto ETF helps to diversify the risk exposure to one single asset by holding multiple digital assets in a weighted portfolio. As well as taking away the security concerns of holding the assets yourself.

The benefits of investing in a cryptocurrency ETF are that it would provide exposure to the underlying asset without the need to actually purchase and store the digital currency. It would also be traded on an exchange like a stock, providing liquidity and price discovery.

One of the first crypto ETFs to launch on the New York stock exchange was ProShares Bitcoin ETF. Since then many ETFs have been approved in Australia

How do Cryptocurrency ETFs work?

Cryptocurrency ETFs are designed to track the performance of a certain cryptocurrency, a group of cryptocurrencies or a crypto index or a particular crypto market. For example, there could be an ETF that tracks the top ten performing cryptocurrencies, or one that only tracks Ripple (XRP).

When you invest in a cryptocurrency ETF, you are buying shares of the fund, which then invests in the underlying assets. The fund is managed by an experienced team of financial professionals who will make sure that your investment is diversified and properly allocated.

Some of the benefits of investing in a cryptocurrency ETF may include:

- Access to a professionally managed fund

- Diversification within the asset class

- Removes security/self custody risks

- Access through a regulated fund

If you’re interested in investing in a cryptocurrency ETF, as with any other type of investment, ensure you do your research and understand how the fund works before making any decisions. You can also consult with a financial advisor to get more information.

Advantages of investing in a Cryptocurrency ETF

Cryptocurrency ETFs offer many advantages, including:

-Diversification: A cryptocurrency ETF gives you exposure to a basket of different cryptocurrencies or crypto sectors. Which helps to mitigate the risk associated with investing in any single currency.

-Liquidity: Cryptocurrency ETFs are traded on exchanges just like stocks, so they offer greater liquidity than investing in a single cryptocurrency.

-Regulation: Cryptocurrency ETFs are regulated by governments and financial institutions, which adds an extra layer of safety and security.

-Professional Management: Professional managers are responsible for selecting and managing the underlying assets.

-Custodial advantage: not having to worry about holding your keys or losing access to your crypto

If you're thinking of investing in cryptocurrencies, a cryptocurrency ETF may be a good option for you. Make sure you do your own research or consult with a financial advisor to see if it's right for your portfolio.

Risks associated with investing in a Crypto ETF

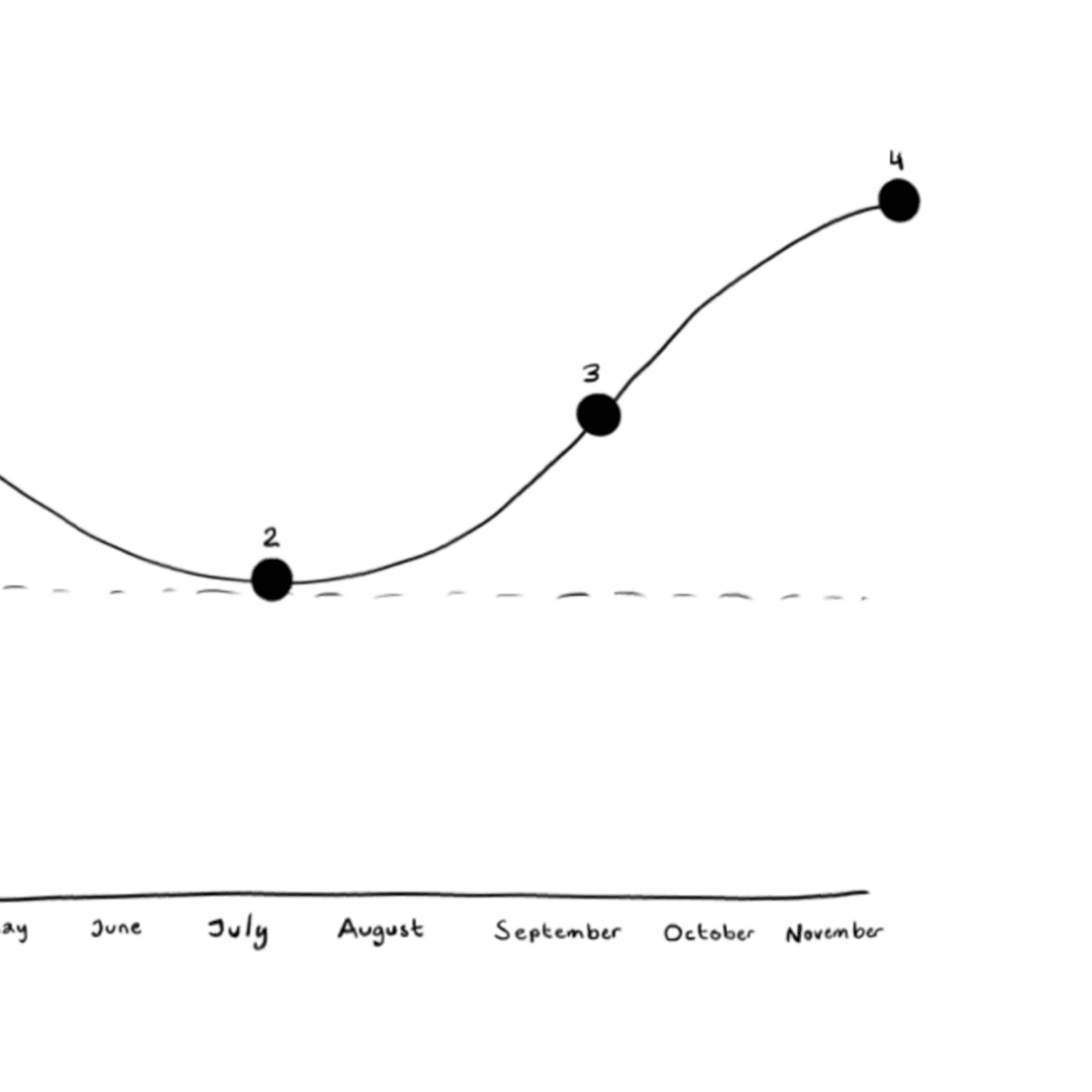

When it comes to investing in a crypto ETF, there are a few risks that you should be aware of. First and foremost, the value of cryptocurrencies can be incredibly volatile. This means that if you invest in a crypto ETF, your investment could go up or down significantly in value over a short period of time.

-Additionally, since crypto ETFs are relatively new, there is still a lot of uncertainty surrounding them. It's possible that regulatory changes or other unforeseen events could adversely impact crypto ETFs in the future.

-Custodial Access: Not your keys, not your crypto is the common saying. See recent events with Celsius as an example.

-Finally, it's important to remember that all investing carries some risk of loss. So, while investing in a crypto ETF may offer the potential for high returns, there is also the possibility that you could lose money.

Now that you know a bit about the risks of investing in a crypto ETF, you may be wondering whether it's worth it. While there is no easy answer to this question, it's important to remember that all investments come with some risk. So, if you're considering investing in a crypto ETF, make sure you understand the risks involved and are comfortable with them before making any decisions.

Crypto ETF & Bitcoin ETF list

-

CRYP (BetaShares Crypto Innovators ETF)

CRYP is one of a few cryptocurrency related exchange traded funds available in Australia. It invests in up to 50 cryptocurrency related businesses and doesn’t directly hold any digital assets. Some of the businesses include crypto exchanges, blockchain technology companies and crypto mining platforms.

CRYP is available via BetaShares which is a well known ETF provider.

-

EBTC (21 Shares Bitcoin ETF)

The EBTC exchange traded fund is one of a few bitcoin etfs that aims to track the price of bitcoin. It does this by providing investment exposure to bitcoin, without the user directly holding the digital asset. It takes a management fee for the service. This ETF is available on the CBOE Australia exchange platform.

-

CBTC (Cosmos Purpose Bitcoin Access ETF)

The CBTC bitcoin ETF is a trust established under the laws of the Province of Ontario, Canada, and is quoted on the Toronto Stock Exchange (TSX). The goal of the CBTC exchange traded funds is to provide investors exposure to the price movement of bitcoin.

-

DIGA (Cosmos Global Digital Miners Access ETF)

The DIGA ETF provides access to the digital asset class for potential investors. It invests across the cryptocurrency space and is a blockchain related etf as it focuses on crypto mining & infrastructure. So this ETF doesn’t track the price of bitcoin, but rather the performance of the Global Digital Miners Access Index.

-

BT3Q (Qoin Shares Bitcoin Feeder ETF)

The BT3Q bitcoin ETF provides investors with exposure to the digital asset class and the performance tracks the value of bitcoin.

How to invest in a Cryptocurrency ETF

Once you have made the choice around what crypto ETF you want to buy, you can invest in a crypto ETF in a few simple steps.

-

Sign up to a brokerage account that facilitates share trading.

-

Fund your brokerage account

-

Search for your desired Crypto ETF and purchase it.

FAQs about Crypto ETFs

-

Are crypto ETFs regulated?

Yes. Any crypto ETF that is offered in Australia is regulated by the Australian Securities and Investment Commission (ASIC). This means investors can gain exposure to digital assets through a regulated ETF offering.

-

Is a bitcoin ETF better than owning bitcoin?

This is likely to come down to personal preferences and what you are trying to achieve by investing. There are some benefits to owning a bitcoin ETF over directly owning bitcoin, such as; not having to hold your keys or store the assets safely. This takes a lot of risk off the table compared to holding bitcoin directly.

For some this might be okay, while others may not like the idea of not actually holding the assets themselves. Additionally if you hold bitcoin directly you do have the option to lend it out to earn yields that may be higher than dividends received from the ETF. That is why there is no definitive answer to this question and it comes down to your personal preference.

-

Do crypto ETFs have a minimum investment limit?

The minimum investment limit is usually set by the investment broker you are using. It is therefore possible for the same ETF to have a different minimum investment limit. Broker "A" may have a $100 minimum investment limit while Broker "B" may have a $500 minimum investment limit.

So it's best to do your research and look at what platforms offer their users if you are looking at investing into a crypto ETF.

Final Thoughts

While you can invest directly in crypto using a crypto exchange or via the Bamboo App, you may also want to consider investing with a crypto ETF. Hopefully this post has explained what a crypto ETF is as well as the associated pros and cons with doing so.

Active vs Passive Investing: What's the Difference

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter